TL;DR:

Sell on a regulated centralized exchange to convert crypto to fiat, or use P2P, a crypto ATM, or an OTC desk for larger amounts. Expect KYC, fees, settlement delays, and tax reporting obligations. Choose a method based on trade size, urgency, and your jurisdiction.

Primary Methods to Convert Crypto to Fiat

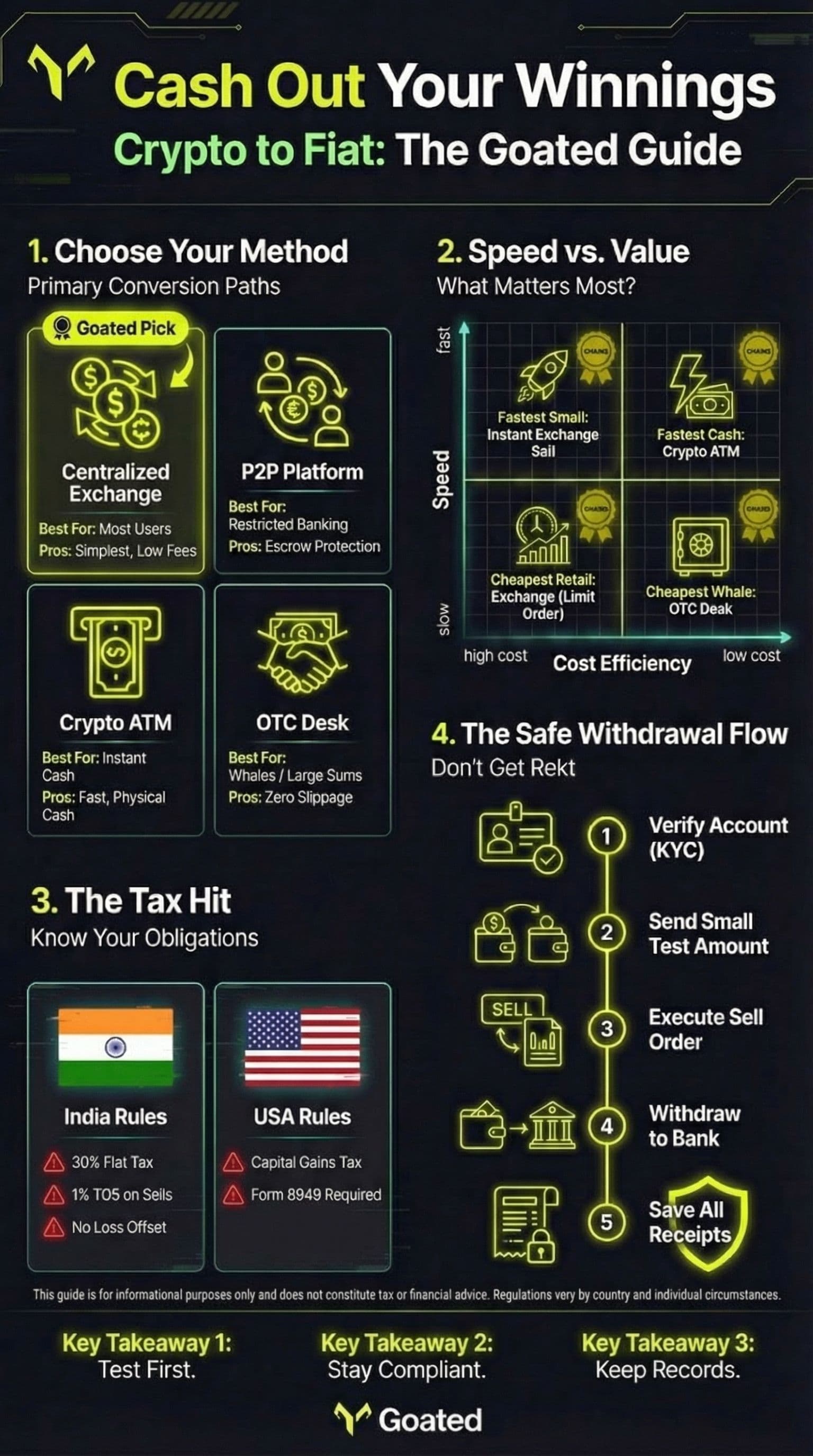

There are several ways to convert your crypto winnings to traditional currency:

- Centralized exchanges (simplest for most users)

- Peer-to-peer (P2P) platforms

- Crypto ATMs (sell-enabled)

- Over-the-counter (OTC) desks (for large trades)

- Crypto debit cards (spend directly or withdraw)

Centralized exchanges are the most straightforward: deposit or hold crypto on the exchange, sell into your local currency, then withdraw to your bank. Crypto ATMs let you withdraw cash but typically have higher fees and limits. OTC desks handle large volumes with minimal slippage but require institutional onboarding.

All methods require KYC (Know Your Customer) verification and are subject to anti-money laundering (AML) screening and tax rules.

Common Questions

Which method is fastest and cheapest?

- Fastest for small amounts: An exchange instant sell to a fiat balance, then instant bank card withdrawal (when supported)

- Fastest for cash on the spot: A sell-enabled crypto ATM (expect higher fees and lower limits)

- Cheapest for small retail trades: Large centralized exchanges during regular hours—order-book liquidity lowers slippage

- Cheapest for large trades: OTC desks to avoid market impact and slippage

Will my bank accept the withdrawal?

Banks vary by country and policy. Many banks accept transfers from regulated exchanges if you provide proof that funds originate from a regulated platform along with KYC documentation. Some banks may flag or block transfers linked to unregulated platforms. Always use regulated exchanges or licensed payment processors to reduce rejection risk.

Do I need to report taxes when I cash out?

Yes. Selling crypto for fiat is a taxable event in most jurisdictions.

Tax Rules by Region

India

India taxes crypto gains at a flat 30% rate plus 4% cess (totaling 31.2% on gains). Additionally:

- 1% Tax Deducted at Source (TDS) applies on the sale of crypto assets exceeding ₹50,000 (or ₹10,000 in certain cases) within a single financial year

- No loss offset allowed—crypto losses cannot be set off against other income or even other crypto gains

- 18% GST on crypto service fees (effective July 7, 2025) applies to spot trading, futures, derivatives, fiat transactions, and withdrawals

Exchanges operating in India routinely deduct TDS where applicable. Keep detailed records of cost basis, transaction dates, and TDS receipts for filing. Crypto gains must be reported under Schedule VDA in your Income Tax Return.

Important: Consult a local tax professional for precise filings, especially given the evolving regulatory landscape.

United States

In the US, crypto transactions must be reported to the IRS and gains or losses included on your tax return:

- Crypto is treated as property for tax purposes

- Capital gains tax applies when you sell or dispose of crypto

- Form 8949 and Schedule D are used to report gains and losses

- Starting in 2025, brokers will issue Form 1099-DA reporting gross proceeds from digital asset sales

- You must answer the digital asset question on Form 1040

From 2026, brokers will also report cost basis. Wallet-by-wallet tracking becomes mandatory for cost basis calculations starting January 1, 2025.

Europe and UK

European and UK banks often require proof of regulated exchange origin and compliant KYC. If your exchange loses banking partners, withdrawal options may change—always verify current options before initiating large withdrawals.

Step-by-Step Withdrawal Processes

Option A: Centralized Exchange (Best for Most Users)

- Choose a reputable exchange that supports your fiat currency and local bank withdrawals

- Complete account verification (KYC) and link your bank account

- Transfer or deposit crypto into your exchange wallet (for large transfers, send a small test amount first)

- Place a sell order: market sell for speed, or limit sell for a better price

- Once fiat settles into your exchange balance, choose your withdrawal method: bank transfer, instant card payout, or wire

- Withdraw to your bank and keep exchange withdrawal receipts

- Save all trade records for tax reporting

Option B: Peer-to-Peer (Useful Where Banking Rails Are Limited)

- Use a vetted P2P marketplace with escrow protection

- Create a sell order specifying payment methods you accept

- Verify buyer reputation and wait for escrow payment confirmation

- Confirm receipt in your bank, then release crypto from escrow

- Record transaction details and counterparty information

Option C: Crypto ATM (Cash on the Spot)

- Locate a sell-enabled ATM near you and check limits and fees

- Follow on-screen steps: choose sell, specify amount, scan QR for your ATM wallet address, send crypto

- Withdraw cash when the transaction confirms

- Keep the receipt for your records

Option D: OTC Desk (For Large Sums)

- Contact an OTC desk and prepare onboarding documents: KYC, AML, proof of funds

- Negotiate price and settlement terms

- Execute the trade and receive fiat via bank transfer

- Keep detailed settlement paperwork for audit and tax purposes

Compliance Checklist

To keep yourself safe and compliant:

- ✅ Always use KYC-compliant platforms for large or frequently moving funds

- ✅ Keep detailed records: cost basis, timestamps, and transaction IDs

- ✅ Save bank statements and exchange withdrawal receipts

- ✅ Consult a local tax professional when cashing out significant amounts

- ❌ Never attempt to evade taxes or hide proceeds

Final Steps

- Decide your route based on amount, speed, and your country's regulations

- Test with a small transfer first and document everything

- Consult a tax expert if you're converting large sums or are unsure about local tax rules

Converting crypto winnings to fiat doesn't have to be complicated. Choose the method that fits your needs, stay compliant with local regulations, and keep thorough records. If you have questions about withdrawing your winnings from Goated, our support team is always available to help.